Author: J.D. Roth / Source: Get Rich Slowly

New here? You may want updates via email or RSS feed. Thanks for visiting!

Across the web, I see other financial bloggers sharing their year-end financial summaries. Some folks had good years. Financial Samurai’s net worth increased by 6.5% in 2018. Others had mediocre years.

Fritz at The Retirement Manifesto saw his net worth decline by 2.1% thanks to a volatile stock market.Me? Well, I’m embarrassed to share how my year went financially. It sucked. No, seriously. It was terrible.

My net worth declined by 15.2% in 2018 — nearly $250,000!

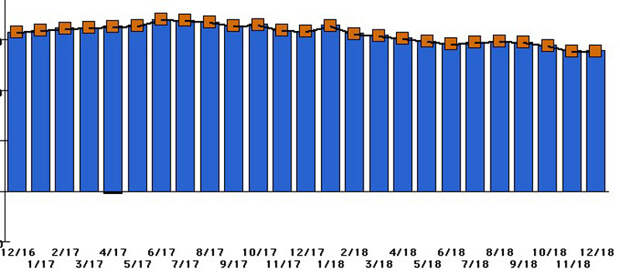

Here’s a graph of the monthly changes to my net worth during the past two years:

What happened? Did I buy a Lamborghini? Did I spend a ton during my recent three-week trip to Europe? Have Kim and I been binging on cocaine and chocolate? Nope. While there’s no doubt that my habits contributed to my loss of wealth, there are larger forces at play here.

Let’s take a closer look.

Note: As a reminder, your net worth is a snapshot of your financial health. It’s what you own minus what you owe. While not a perfect measure, net worth is a useful tool for tracking your financial progress. Want more info? Here’s how to calculate your net worth (and what to do with it).

Three Big Bruises

It’s easy for me to rationalize my huge decline in net worth, to explain that it’s mostly just smoke and mirrors. But I can’t help thinking I’m fooling myself. Let me explain.

My loss of wealth seems to be due to three main factors:

- Ongoing home improvements. Kim and I moved from our penthouse condo to this country cottage eighteen months ago. One of our goals was to reduce the “carrying costs” of owning a home. We achieved that. Living here costs us about $725 less each month than living in the condo. But we’ve also dealt with over $100,000 in necessary home repairs. Holy cats! (And right now, the kitchen sink is leaking. Ugh.)

- The re-acquisition of Get Rich Slowly. I can’t reveal how much I paid to purchase this site from its previous owners, but it’s a significant chunk of change. Plus, I’ve put additional money into GRS for growth and development.

- Investment losses. In 2018, the S&P 500 fell by 6.2%. That hurt my net worth. But I also lost money investing in other small businesses. (I’ll write about this in the future. It’s one of those “it seemed like a good idea at the time” things that’s actually been a poor choice for me.)

It’s obvious how the investment losses effect my net worth, but let’s explore the first two points.

In theory, the improvements we’ve made to our home should increase its value.

We’ve spent a grand total of (drumroll, please) $143,290.09 on remodeling projects since we moved in, which is nearly one-third of the $449,665.36 purchase price. However, that doesn’t mean the home is now worth $587,959.64. (I wish!) I’d be happy if we recouped 50% of our costs, which means our place is probably worth about $516,314.60.

That said, for accounting purposes, I treat remodeling expenses as if that money is simply gone, as if I’d spent it on something disposable. Meanwhile, Zillow says our home is worth $428.068.00. In other words, the combination of home improvements and declining property values has dinged my net worth by $160,000!

A similar thing happened with Get Rich Slowly. Technically, purchasing the site shouldn’t have affected my net worth (assuming it’s worth what I…

The post My 2018 year in review appeared first on FeedBox.