Author: J.D. Roth / Source: Get Rich Slowly

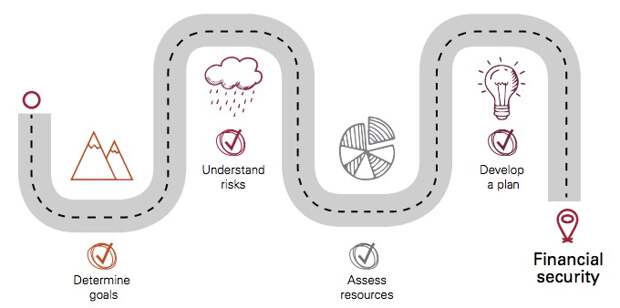

Vanguard, the mutual fund company, recently published a free retirement planning guide for folks like me who aren’t interested in hiring a professional financial advisor. Vanguard’s Roadmap to Financial Security is a 32-page document intended to provide DIY investors with a framework for decision-making in retirement.

Here’s an excerpt from the intro to this retirement planning guide:

Retirement is complex. In the face of often competing goals and numerous risks, the choices can be overwhelming, leaving many retirees unsure of where to begin. To help balance the many decisions to be made, we have constructed a retirement planning framework that allows retirees to capture their unique priorities and use their financial resources in a way that best aligns with achieving their goals and mitigating their risks.

Like me, Vanguard believes that retirement planning starts by setting goals. What do you want to get out of life? In the case of retirement, how much do you want to spend on basic living expenses? How much do you want to have set aside for “contingencies”? How much do you want to spend on fun? How much do you want to leave after you die?

Next, Vanguard’s retirement planning guide spends six pages exploring the risks of retirement and how to mitigate them. According to Vanguard, there are five primary risks in retirement:

- Market risk, the possibility of losing purchasing power due to movements in the financial markets.

- Health risk, a combination of your physical…

The post Free retirement planning guide from Vanguard appeared first on FeedBox.