If the creators of Bitcoin wanted it to act like a currency, they sure made a lot of weird decisions. Bitcoin doesn’t function well as a currency, for reasons that are inherent to its design. It’s an investment people are speculating on…and even then, it’s more gambling than it is a stable investment.

Bitcoin’s Value Is Too Unstable

A currency should have reasonably stable value, rather than swinging wildly. But that’s what Bitcoin does. Over just a few days, it’s not uncommon for Bitcoin to go up or down 25%. As Bitcoin skyrockets in value, this has become even more of a concern.

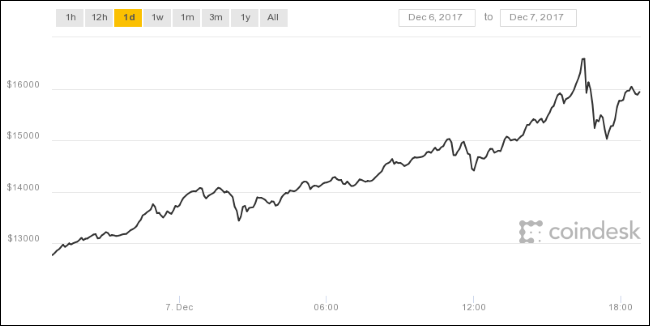

For example: According to Coindesk, Bitcoin went from under $12770 to $16583 in a less than 24 hour span between December 6 to December 7.

It’s easy to find more examples. In the four day span of November 8 to 12, Bitcoin sunk from $7458 to $5857. In the three day span of December 3 to 6, Bitcoin increased from $11180 to $12168. These are huge swings in value that make it impossible to predict the value of what you’ll be exchanging or receiving for a good or service—and incredibly difficult for merchants to price those goods. In fact, it’s one reason Valve stopped accepting Bitcoin on Steam on December 6, 2017.

In comparison, the US Consumer Price Index (CPI), a measure of inflation, has averaged less than 2.5% inflation a year over the past decade.

Even as an investment vehicle, Bitcoin is terrible. Robert Shiller, an economics professor at Yale who won a Nobel prize for his work on bubbles, said Bitcoin is “the best example right now” of a bubble.

Compared to other investments, Bitcoin looks more like a get-rich-quick scheme than a long-term, stable investment. Stable index funds have historically returned about 7% every year on average and are a good place to park your money—not an unpredictable, wildly unstable asset like Bitcoin.Transaction Fees Are Huge

Bitcoin transaction fees are also huge, and like Bitcoin itself, they can vary. To get your transaction processed in a reasonable amount of time, you have to pay more, basically putting up a larger reward to get Bitcoin miners to incorporate your payment into the blockchain.

According to Valve, the average fee paid to purchase something recently topped out at $20. This also varies wildly. On December 7, bitcoinfees.info said that the current fee was over $13 per transaction.

That’s a huge cut of every single transaction, and it means Bitcoin would be a terrible currency for everyday purchases. Would you use a debit card if you had to pay $13 for every single transaction, even if it’s just a $3 cup of coffee?

As there are fewer and fewer Bitcoins to be mined, transaction fees will increase to pay miners for the computing power they need to spend to keep the system going. So transaction fees are designed to get higher and higher over time.

In comparison, debit card transactions cost $0.21 plus 0.05% of the total payment in the USA, while credit card transactions cost between 1.43% and 3.5% of the payment.

Transactions Take Forever

Bitcoin transactions aren’t just expensive: they also take a long time. This isn’t an accident, but, again, is part of the design of Bitcoin.

Receiving six network confirmations, the generally accepted standard for confirming a Bitcoin transaction, can take up to an hour—or potentially longer, as there are no guarantees.

Commerce would grind to a…

The post Bitcoin Is Not a Currency, It’s an (Unsafe) Investment appeared first on FeedBox.